About BNP Paribas Bank Polska

In Poland, BNP Paribas Bank Polska S.A. provides services to retail customers and other segments, including Wealth Management, microbusinesses, SMEs, and corporate banking.

As part of the BNP Paribas group, a prominent European bank with a global presence, BNP Paribas Bank Polska offers responsible and innovative financial solutions that help their customers change their world and support the Polish economy.

Damian Rybiński and his role at BNP Paribas Bank Polska

As an Agile Coach at BNP Paribas Polska, Damian plays a pivotal role in supporting agile transformation goals. His responsibilities include working with Tribe Leaders, coaching and mentoring Scrum Masters, and ensuring overall effectiveness, efficiency, and predictability within the tribes.

"It's a wide role in our organization. In a nutshell, as an Agile Coach, I support tribes by being a lean-agile leader, coach, mentor, and doer—depending on the situation."

Background

BNP Paribas Bank Polska has been using ActionableAgile™️ Analytics for Jira for over a year now. 55 Degrees is excited to build a long-term relationship with BNP Paribas Bank Polska as they continue their Agile Transformation.

The Situation

Generally speaking, being Agile at Scale is an incredibly hard feat to pull off. With over 8000 employees in Poland and nearly 4.2 million customers, BNP Paribas Bank Polska faces the monumental challenge of implementing agile practices across a vast and diverse organization. The complexity of the banking sector added another layer of difficulty, making it essential to find solutions that could simplify processes while maintaining high standards of quality and predictability.

BNP Paribas Bank Polska was motivated to move away from the limitations of out of the box gadgets and filters within JIRA and Confluence, which they found to be cumbersome and inefficient. Instead, BNP Paribas Bank Polska sought a solution that seamlessly integrated with JIRA and offered a comprehensive visualization of flow metrics and data that could enhance decision-making and operational efficiency.

Limited predictability and metrics

BNP Paribas Bank Polska faced challenges in accurately tracking metrics and achieving predictability. Their previous reliance on native JIRA features and Excel for flow metrics visualization didn’t provide the insights they were looking for, despite the extra effort required to use them.

The lack of a seamless and intuitive tool for connecting and visualizing data meant that the organization struggled to build reliable forecasts. It was nearly impossible to make the informed, data-driven decisions required to manage project timelines and expectations effectively.

"We knew that if we wanted to build predictability, we had to take care of flow metrics."

The standard process at scale

Achieving standard processes at scale was a significant challenge for BNP Paribas Bank Polska. The organization struggled to establish a straightforward connection with Jira to visualize data metrics. This led to them prioritizing “ease of use” as one of the key criteria when assessing new tools.

The complex banking environment further complicates processes' efficient implementation and standardization, making it difficult to ensure consistent and effective practices across all teams. For instance, different regulatory requirements across regions, varying legacy systems, and the high volume of transactions all contribute to the complexity.

The Solution

ActionableAgile™️ Analytics for Jira

BNP Paribas Bank Polska considered several alternative solutions but ultimately chose ActionableAgile Analytics for its ease of implementation, advanced flow metrics, and customer support around the tool.

Recognizing that a successful rollout of the ActionableAgile Analytics was of utmost importance, the BNP team held multiple sessions with 55 Degrees while assessing the tool.

To prepare, 55 Degrees conducted introductory training courses with the Scrum Masters, after which BNP held internal training sessions for their leadership.

BNP Paribas Bank Polska attributes their success not only to choosing the right solution, but also to their thorough preparation. This is evident in the rapid and widespread adoption of their practices by over 150 squads across the company.

Catalyzing change across 150 squads

Implementing ActionableAgile Analytics across 150 diverse squads has been a transformative force at BNP Paribas Bank Polska. The tool has addressed the need for ease and scalability in a challenging banking environment by simplifying complex processes and providing straightforward metrics visualization.

The comprehensive training sessions for Scrum Masters and other leaders ensured effective adoption, which was crucial given the complexity and scale of operations. This facilitated a unified approach to managing flow metrics, making spreading these practices easier across all teams.

With the value of ActionableAgile Analytics proved internally among the initially trained squads, BNP felt confident in rolling the tool out to approximately 150 existing squads across the company in 2023.

"In agile transformation, Agile Coaches and Scrum Masters often do things that the business doesn't see. Having the data to demonstrate the benefits makes it much easier to collaborate."

Common language around metrics (It IS possible!)

BNP Paribas Bank Polska is deep into its third year of Agile transformation, and the integration of ActionableAgile Analytics has played a pivotal role in establishing a common language around flow metrics. Before the implementation, many people within the organization had never heard of flow metrics.

Establishing a shared language and cultivating a unified mindset has been pivotal for successful implementation.

Damian highlighted that Scrum Masters now use flow metrics during events and meetings, enabling diverse teams to benefit from a standardized approach, regardless of their specific frameworks or methods.

Scrum Masters can fully leverage the tool while addressing any blockers or impediments that arise inside their tribes.

"The actions of standardizing processes and implementing ActionableAgile™️ Analytics to predictability have been crucial factors in our success."

Happy Business Leaders

In today's financial climate, demonstrating the business value of third-party tools to leaders is crucial. At BNP Paribas Bank Polska, showing business leaders the value of ActionableAgile Analytics has been quite effective.

Damian: "We showed the relationship between reducing Work In Progress and shortening Cycle Time or between reducing Work In Progress and increasing Throughput—the number of items we delivered. This allowed business leaders to see these correlations clearly. And since they see the benefits and the real data, they are more eager to work with us to make it even better. It's important for them to see the real data and benefits."

Real data is displayed to leadership during strategic events. This image notes the correlation between reducing Work in Progress and reducing Cycle Time.

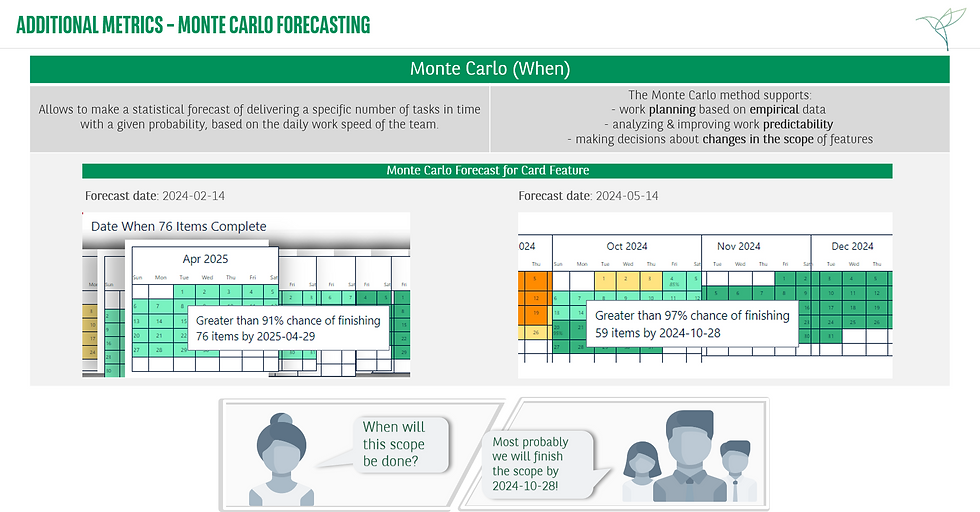

Real data is displayed to leadership during strategic events. This image shows how the team asses release plans based on Monte Carlo Simulations.

Predictable Predictability

The implementation of ActionableAgile Analytics has significantly enhanced predictability at BNP Paribas Bank Polska.

By leveraging Monte Carlo simulations and metrics such as Cycle Time and Throughput, teams can now provide accurate forecasts and answer the critical question, "When will it be done?" This level of predictability is essential for planning effectively and for meeting stakeholder expectations.

Additionally, The tool has enabled a common approach to monitoring work progress and delivery dates, making it a valuable asset for ensuring timely and reliable outcomes.

Simplified complex processes for over 150 teams, making metrics easier to understand and improving scalability.

Successfully implemented unified flow metrics management along with a common language for flow metrics.

Strengthened collaboration with business leaders by showing clear benefits and real data, gaining their support for agile projects.

Improved predictability with accurate forecasting and timely delivery using metrics and simulations, meeting stakeholder expectations.

What does the future look like for BNP Paribas Bank Polska?

Continuing the standardization of metrics - step-by-step

BNP Paribas Bank Polska plans to continue standardizing the Cycle Time and Work Item Age metrics across the organization to further enhance predictability and efficiency. This ongoing effort involves gradually implementing additional ActionableAgile Analytics metrics and ensuring that all squads are aligned in their use.

The bank recognizes that achieving high levels of consistency and quality in its processes is crucial for maintaining its competitive edge in the complex banking sector.

Damian: “We believe these follow-ups are crucial when it comes to standardizing the tool. You have to have a plan because it's impossible to implement everything at once.”

Cultivating agile excellence 🥚

Maintaining an agile mindset is a key internal objective driven by the need to enhance predictability, quality, and process efficiency.

Thus, internal chapters within BNP Paribas Bank Polska, the Agile Excellence Chapter and Efficiency Excellence Chapter, have established a dedicated ‘Flow Metrics Circle 🥚’ (informally known as EGG internally) to support the standardization of flow metrics.

Damian: “We need to build predictability. We need to take care of our quality and we need to shorten our feedback cycles in the most innovative and complex areas. We need to have better processes that are not only faster, but also better in terms of quality and more accurate when it comes to market’s requirements."

Comments